Top 10 CBDC Projects in 2025: Tracking the Digital Currency Race Across the Globe

The Top 10 CBDC projects in 2025 reveal just how quickly central bank digital currencies have transitioned from research pilots to active rollouts. With 137 countries now exploring CBDCs, covering nearly all of global GDP, these projects highlight different national priorities — whether advancing financial inclusion, improving cross-border payments, or strengthening geopolitical influence.

Why CBDCs Are Front and Center in 2025 – Top 10 CBDC

Central bank digital currencies, or CBDCs, are digital forms of sovereign money issued directly by central banks. Some, known as retail CBDCs, target consumers and small businesses. Others, wholesale CBDCs, are meant for settlement between banks and institutions. By early 2025, three retail CBDCs had launched, nearly 50 projects were in pilot phase, and several wholesale collaborations had reached advanced testing. The reason is clear: CBDCs address financial access gaps, reduce dependency on cash, and provide governments with new tools in a digital-first economy.

Global Drivers Behind CBDC Adoption – Top 10 CBDC

The momentum comes from overlapping forces. In emerging markets, CBDCs are designed to expand financial inclusion and lower transaction costs. In advanced economies, they aim to safeguard monetary sovereignty as crypto and stablecoins gain traction. Cross-border experiments like Project mBridge show how wholesale CBDCs could replace outdated correspondent banking models. And globally, the decline in physical cash and rise of programmable payments make CBDCs an inevitable evolution of money.

1. China – Digital Yuan (e-CNY)

Sourrce: Coin98

The Digital Yuan remains the world’s largest CBDC pilot, with transactions topping 7 trillion yuan in 2024. By 2025, its reach has spread across transport, healthcare, and tourism. China also continues to test cross-border use through Project mBridge, making the e-CNY both a domestic innovation and a strategic tool for international trade.

2. India – Digital Rupee (e₹)

Source: India today

India’s Digital Rupee has become the second-largest CBDC experiment worldwide. Circulation rose over 300% in a year, reaching more than ₹10 billion by 2025. India emphasizes offline payments to support rural areas, while also trialing wholesale applications. The project reflects India’s dual goals: inclusion for citizens and modernization for financial markets.

3. European Central Bank – Digital Euro

The Digital Euro is in advanced pilot stages. Its design emphasizes privacy protections and holding caps to avoid destabilizing banks. Wholesale trials run alongside consumer-facing pilots, signaling Europe’s intent to strengthen the euro’s role in global trade. For Brussels and Frankfurt, the digital euro is as much about politics as it is about payments.

4. Nigeria – eNaira

Source: Nairametrics

Launched early, the eNaira is a retail CBDC built for inclusion. Adoption challenges remain — from low awareness to skepticism among merchants — but Nigeria’s government continues to integrate it into public services and welfare programs. The eNaira provides valuable lessons for other African countries preparing their own digital currencies.

5. The Bahamas – Sand Dollar

Source: CoinGeek

The Sand Dollar, launched in 2020, remains the first fully deployed CBDC. While modest in size, it addresses unique challenges like banking access across dispersed islands. It has practical applications in tourism and retail, offering a roadmap for other small nations seeking to digitalize payments.

6. Jamaica – JAM-DEX

JAM-DEX focuses squarely on financial inclusion, offering digital wallets for the unbanked and small businesses. Incentives, including government payments delivered through the system, encourage adoption. The rollout is gradual but significant, marking Jamaica as one of the earliest full CBDC adopters in the Americas.

7. Project mBridge – Hong Kong, Thailand, UAE, Saudi Arabia

Source: LedgerInsights

This wholesale project has evolved into a global model for cross-border payments. Project mBridge brings multiple central banks together to test direct settlements without relying on U.S. dollar networks. Early trials show faster and cheaper transactions, making it a potential disruptor for global trade settlement systems.

8. Project Dunbar – Australia, Singapore, Malaysia, South Africa

With leadership from the BIS Innovation Hub, Project Dunbar explores interoperability among wholesale CBDCs. It tackles issues like legal frameworks and shared technical standards. Though still in development, it could shape future multi-currency platforms, especially in regions with strong trade ties.

9. Eastern Caribbean Central Bank – DCash

Source: Dcash

The DCash initiative brings a shared CBDC to several Caribbean nations, making it one of the few regional digital currencies. Despite setbacks such as technical outages, improvements in infrastructure continue. DCash demonstrates how small economies can collaborate to enhance regional financial stability and digital adoption.

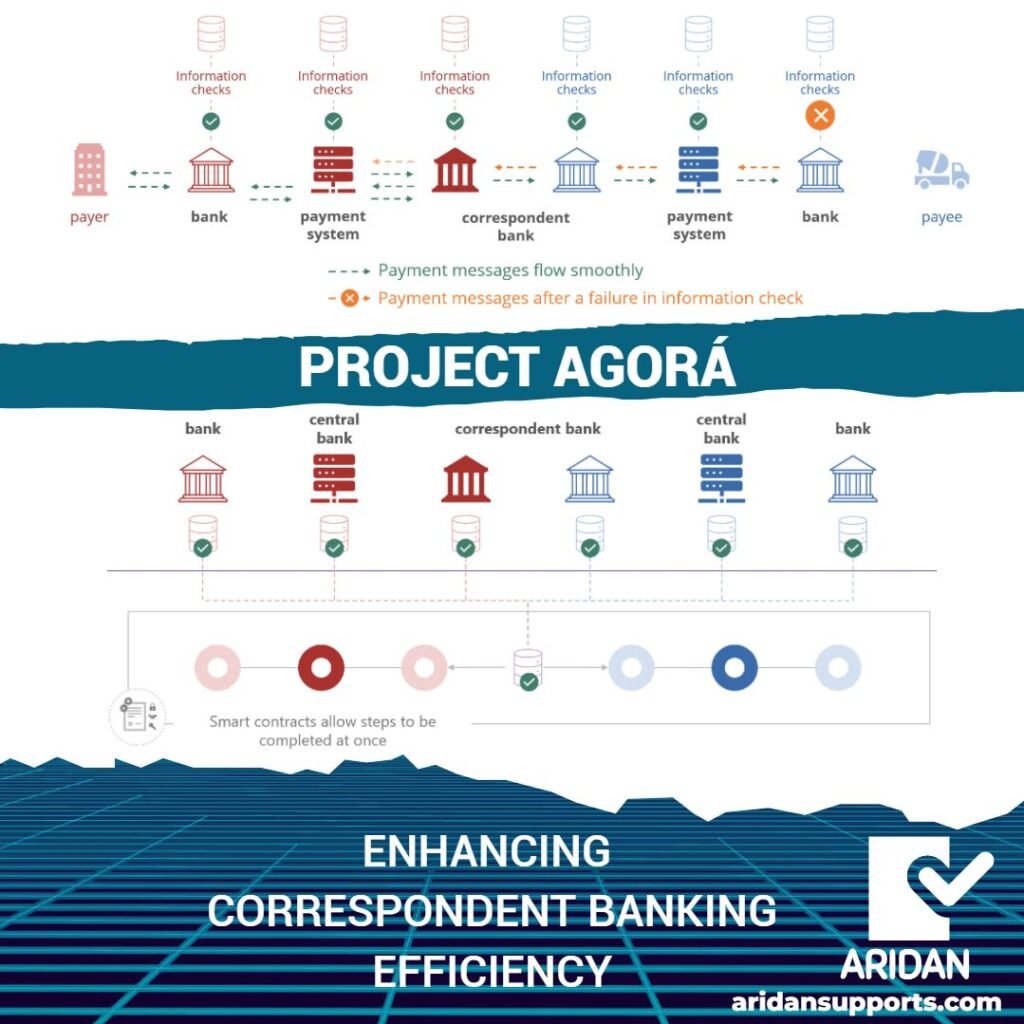

10. United States – Project Agorá

Source: Aridan

The U.S. may have paused its retail CBDC plans due to political resistance, but it remains active in wholesale research through Project Agorá. Working with major central banks, the project explores cross-border settlement frameworks. America’s cautious stance reflects a balance between innovation and maintaining the dollar’s global dominance.

Comparing the Leaders – Top 10 CBDC

In 2025, retail CBDCs are gaining ground in emerging economies like China, India, Nigeria, and Jamaica. Meanwhile, wholesale CBDCs — the Digital Euro, mBridge, and Dunbar — are shaping global settlement systems. Projects like DCash highlight regional collaboration, while the U.S. emphasizes wholesale caution over retail rollout.

Challenges Ahead – Top 10 CBDC

CBDCs face hurdles: risks of bank disintermediation, cybersecurity vulnerabilities, privacy debates, and the cost of building secure infrastructure. Adoption is another obstacle — without trust and usability, even ambitious projects struggle to gain traction. Nigeria’s experience underscores this reality.

Conclusion: A New Era for Central Bank Money -Top 10 CBDC

By 2025, CBDCs have entered their defining moment. The Top 10 CBDC projects in 2025 showcase a spectrum — from China’s expansive Digital Yuan to the Bahamas’ small but pioneering Sand Dollar. Whether retail or wholesale, these projects are shaping the architecture of future money. The question now is not whether CBDCs will matter, but how deeply they will reshape the financial system over the coming decade.